Main content:

1. Analysis of ternary cathode material market

In 2022, the global output of ternary cathode materials was about 993,000 tons, a year-on-year increase of more than 30%. Among them, the shipment of high-nickel cathode materials was about 328,000 tons, a year-on-year increase of 64%.

In 2022, the annual production capacity of China's ternary cathode materials would exceed 1 million tons, and the output will reach 656,000 tons, an increase of about 67% compared with 2021. Among them, the penetration rate of high-nickel materials (8 series and above) reached 44.7%, a year-on-year increase of 76.9%.

In 2022, China's trade volume of ternary cathode materials will be large, but the overall net trade volume will be small. In 2022, China's apparent consumption is almost close to production, at 658,000 tons.

In 2022, the ternary cathode material market will still continue the trend of high nickel, and the iterative upgrading of products will continue to accelerate. At the same time, China is leading the development and trend of the global ternary cathode material market.

2. China top 10 ternary cathode material companies

There are many companies manufacturing ternary cathode material companies, but the question is “how can you pick the best ternary cathode material companies among these worthy contenders?” To answer your questions, we sorted out, analyzed and summarized the relevant information of top 10 ternary cathode material companies in China, as follows:

|

Ranking |

Company |

Ternary cathode material production capacity |

Production (tons) |

|

1 |

Ronbay |

250,000 tons |

91401 |

|

2 |

Tianjin B&M |

93,000 tons |

90000 |

|

3 |

Easpring |

80,000 tons |

66000 |

|

4 |

Hunan Changyuan Lico |

47,000 tons |

62715 |

|

5 |

ZEC |

67,000 tons |

47000 |

|

6 |

BTR |

70,000 tons |

46400 |

|

7 |

BASF Shanshan |

62,000 tons |

46000 |

|

8 |

Nantong Reshine |

70,000 tons |

40000 |

|

9 |

XTC New Energy |

60,000 tons |

30000 |

|

10 |

Jiangmen Umicore Changxin |

45,000 tons |

25000 |

① Ronbay

|

Established date |

September 18, 2014 |

|

Company location |

Zhejiang, China |

|

Total market value |

30.268 billion RMB |

|

Company website |

http://www.ronbaymat.com/ |

Ronbay specializes in the R&D, production and sales of cathode materials for lithium batteries. The core products are NCM811 series, NCA series, Ni90 and above ultra-high nickel series ternary cathode and precursor materials.

In 2022, the total sales volume of Ronbay's high-nickel 8 series and above ternary cathode products will be nearly 90,000 tons, a year-on-year increase of 70.13%. Among them, high-nickel, low-cobalt, ultra-high-nickel and other cutting-edge materials have achieved thousand-ton shipments. In 2022, the company has built a cathode production capacity of 250,000 tons/year.

The main customers of the company's high-nickel products include CATL, SK on, EVE and other top 10 lithium battery companies in the world. The company's high-nickel products have been introduced into the international mainstream customer supply system, and are currently the first in the world to be widely used in electric vehicle power batteries.

② Tianjin B&M

|

Established date |

August 15, 2002 |

|

Company location |

Tianjin, China |

|

Registered capital |

207.31929 million RMB |

|

Company website |

http://www.bamo-tech.com/ |

Tianjin B&M's main products include ternary cathode materials and lithium cobalt oxide cathode materials.

The company's annual production capacity of cathode materials is 105,000 tons, including 13,500 tons of lithium cobaltate and 93,000 tons of ternary materials. In addition, Guangxi B&M's 100,000-ton high-nickel power ternary precursor and 50,000-ton high-nickel power ternary cathode material production line are under construction.

The company's main customers include CATL, ATL, SDI, LG, BYD, EVE, Lishen, etc. In 2022, the company will ship about 90,000 tons of ternary cathodes and 11,000 tons of lithium cobalt oxide.

③ Easpring

|

Established date |

June 3, 1998 |

|

Company location |

Beijing, China |

|

Total market value |

28.617 billion RMB |

|

Company website |

http://www.easpring.com |

Easpring is the first Chinese company listed on the market with lithium battery cathode materials as its main business. In 2022, Easpring's multi-material production capacity will be 47,000 tons per year, the output will be 63,000 tons, and the capacity utilization will reach 133.1%.

The company's full series of multi-component materials such as ultra-high-nickel, high-nickel, medium-nickel and high-voltage for vehicle power and multi-component materials for energy storage are the first to be applied in large quantities to the global high-end market. High-pressure, long-life NCMA high-nickel products continue to be supplied to international high-end customers.

The company can also provide high-quality lithium battery cathode materials to lithium battery giants and car companies in China, Japan, South Korea, Europe and the United States and other countries and regions. In 2022, the company will export 21,469 tons of multi-component materials, accounting for more than 30% of the total sales.

④ Hunan Changyuan Lico

|

Established date |

June 18, 2002 |

|

Company location |

Hunan, China |

|

Total market value |

27.742 billion RMB |

|

Company website |

http://www.cylico.com/ |

Hunan Changyuan Lico has been engaged in the R&D and production of high-efficiency battery cathode materials since its establishment. In 2011, the company officially entered the field of ternary cathode materials. It is one of the earliest company in China engaged in the research and development and production of ternary cathode materials, and also one of the earliest enterprises in China with mass production capacity of ternary cathode materials.

By the end of 2022, the company's annual production capacity of ternary cathode materials have reached 80,000 tons, and there are still 40,000 tons of projects under construction. In 2022, the total shipment of ternary cathode materials was about 66,000 to 68,000 tons, and the company's net profit per ton of products will be about 22,000 RMB. The products shipped are mainly medium and high nickel products, accounting for more than 80% of the total.

⑤ ZEC

|

Established date |

April 26, 2004 |

|

Company location |

Guizhou, China |

|

Total market value |

16.296 billion RMB |

|

Company website |

http://www.zh-echem.com/ |

Since its establishment, ZEC has focused on the R&D, production and sales of cathode materials for lithium-ion batteries. The company currently has two production bases, located in Guiyang and Yilong New District, Qianxinan Prefecture.

By the end of 2022, the company has built a production line with an annual output of 62,000 tons of cathode materials. At the same time, 4.5 billion RMB was raised to build a new cathode material production line with an annual output of 100,000 tons. It mainly produces high-nickel, medium-high-nickel and medium-nickel ternary cathode materials, and is compatible with the production of sodium-ion battery cathode materials.

⑥ BTR

|

Established date |

August 7, 2000 |

|

Company location |

Guangdong, China |

|

Total market value |

35.576 billion RMB |

|

Company website |

https://www.btrchina.com/ |

BTR is the largest manufacturer of anode materials in top 10 lithium ion battery anode material companies in China. Currently, it mainly produces ternary materials in terms of cathode materials.

In the first half of 2022, sales of cathode materials exceeded 12,000 tons. The BTR cathode material production base is located in Changzhou City, Jiangsu Province, all of which produce high-nickel products.

⑦ BASF Shanshan

|

Established date |

November 13, 2003 |

|

Company location |

Hunan, China |

|

Registered capital |

578.845492 million RMB |

|

Company website |

https://catalysts.basf.com/ |

BASF Shanshan, a joint venture established by BASF and Shanshan in 2021, is one of the world's leading suppliers of lithium-ion battery materials. The product portfolio covers each major system of cathode materials for lithium-ion batteries and precursor products of corresponding specifications, and has formed an industrial chain layout of "raw materials-ternary precursors-cathode materials-battery recycling".

BASF Shanshan's products and businesses cover raw materials, cathode material precursors (PCAM), cathode active materials (CAM) and battery recycling, and it has already occupied a dominant market position in China's battery material market. By the end of 2022, the total production capacity of BASF Shanshan's ternary cathode materials has been 70,000 tons per year.

⑧ Nantong Reshine

|

Established date |

November 16, 2006 |

|

Company location |

Jiangsu, China |

|

Registered capital |

467.80508524 million RMB |

|

Company website |

https://www.reshine.net/ |

Nantong Reshine is a Chinese high-tech enterprise engaged in the R&D, production and sales of cathode materials for lithium-ion batteries. It mainly produces ternary cathode materials and lithium manganate.

The company's products mainly include lithium nickel cobalt manganese oxide (ternary material), lithium manganese oxide, and the products are used in power battery fields such as HEV/48V, PHEV and BEV. It is also widely used in power tools, energy storage batteries (including lifepo4 battery, ternary lithium battery, etc.) and consumer batteries such as mobile phones and notebook computers.

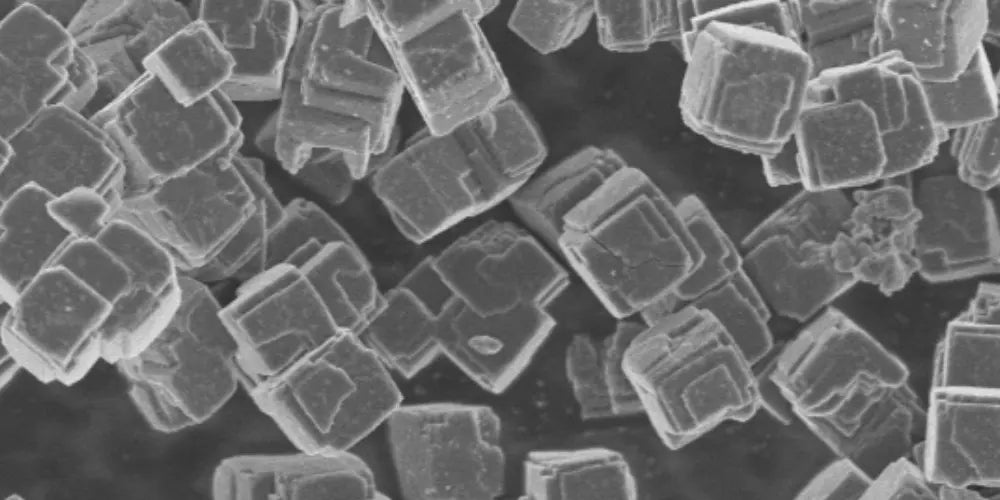

⑨ XTC New Energy

|

Established date |

December 20, 2016 |

|

Company location |

Fujian, China |

|

Total market value |

20.624 billion RMB |

|

Company website |

http://www.xtc-xny.com/ |

XTC New Energy actively develops new energy materials industry including lithium battery cathode materials. Since 2002, the company has successively invested heavily in the establishment of production lines for lithium cobalt oxide, lithium manganese oxide, ternary materials, and lithium iron phosphate.

The company's products cover a full range of energy new material products such as lithium cobalt oxide, ternary materials, precursors, lithium manganese oxide, lithium iron phosphate, high-nickel materials, and NCA. By the end of 2022, the annual output of ternary cathode materials has reached 70,000 tons.

In 2022, the sales volume of the company's ternary materials will reach 46,400 tons, a year-on-year increase of 71.3%. At the same time, the sales volume of lithium cobalt oxide was 33,200 tons, still firmly in the leading position.

⑩ Jiangmen Umicore Changxin

|

Established date |

October 12, 2006 |

|

Company location |

Guangdong, China |

|

Registered capital |

20.624 billion RMB |

|

Company website |

https://www.umicore.cn/ |

Jiangmen Umicore Changxin specializes in the production of cathode materials for lithium-ion batteries and their required precursor materials. At present, Jiangmen has two factories. The annual production capacity of ternary cathode materials is about 45,000 tons. At the same time, a 150,000 tons cathode material project (including lithium cobalt oxide) is under construction.

The main product is lithium manganese nickel cobalt oxide battery cathode material. Now it has an annual production capacity of more than 2,500 tons, and has excellent characteristics such as high safety, high capacity, and long cycle life. It is an excellent substitute product for traditional lithium cobalt oxide.

3. Conclusion

Besides these top 10 ternary cathode material companies in China, there are many other professional companies. The choice of company depends on the needed application. Every company has its strengths, weaknesses, and richer experience in some areas than others. Hope this article can help you find better ternary cathode material companies in China.

Related articles: Top 10 ternary cathode materials manufacturers in the world, Top 10 silicon based anode companies in the world