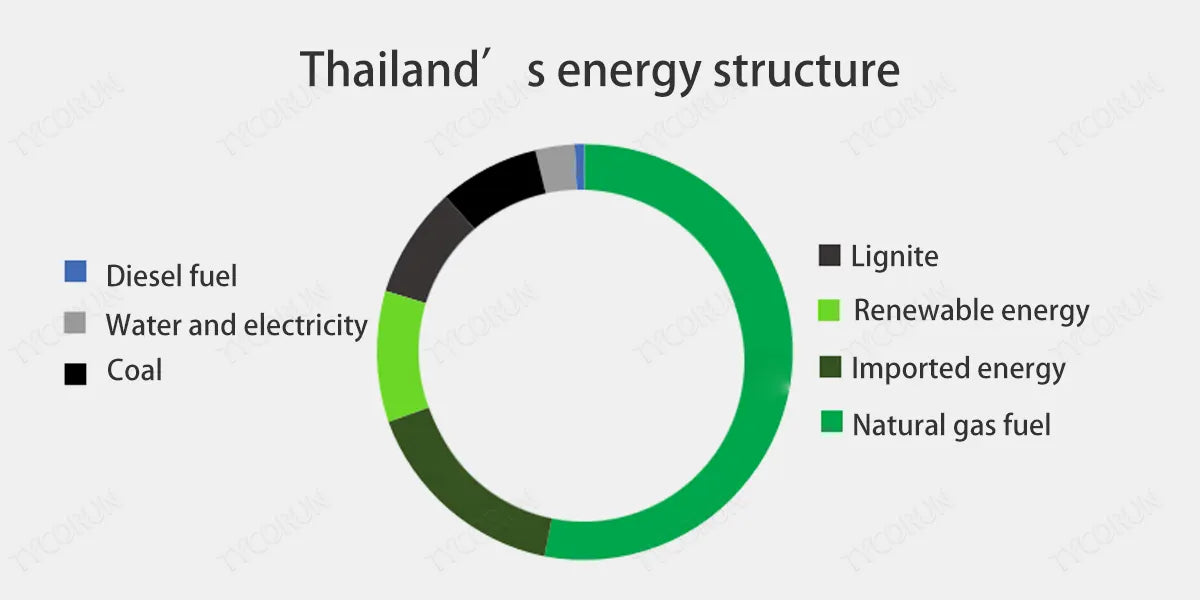

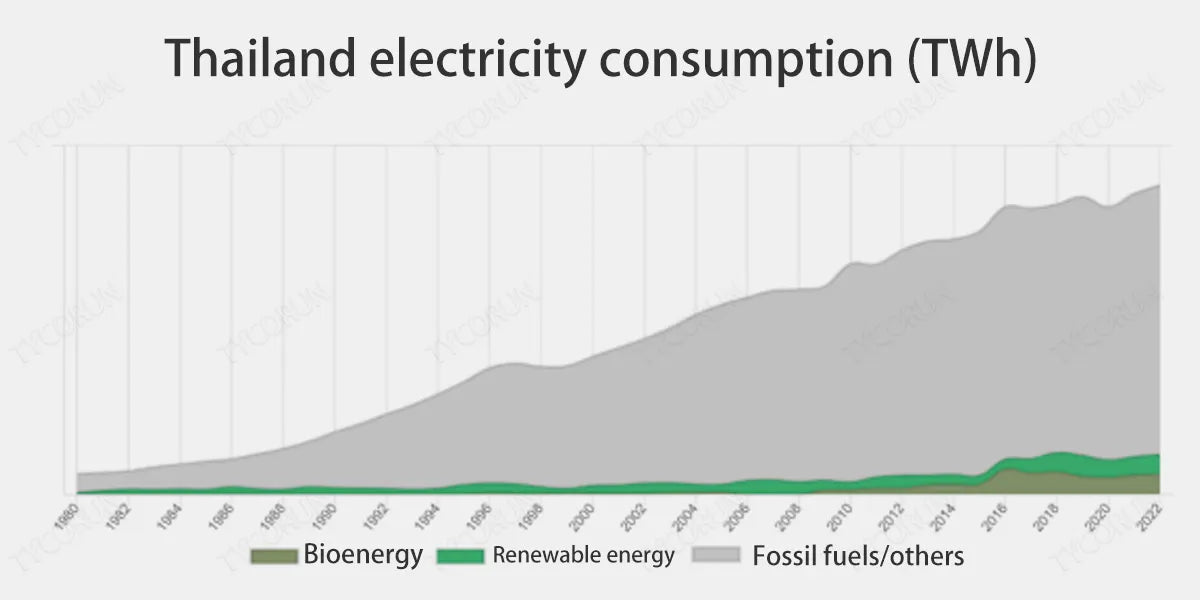

Thailand has been facing major challenges in achieving carbon neutrality and net-zero emission digital circular economy under the firm implementation of the global goals of carbon neutrality. It is mainly due to the country's long-term high economic dependence on fossil fuels, which account for about 76% of energy consumption.

However, in the past year, Thailand has made significant progress in energy diversification, and the proportion of renewable energy (such as solar power in Thailand) has gradually increased. This article will introduce you to solar power in Thailand, including its development potential and development prospects driven by policies.

Main content:

1. Development prospects of solar power in Thailand

At present, traditional fossil energy sources such as natural gas and fuel oil still dominate Thailand’s energy structure, and their use for power generation and transportation of domestic household electricity as well as industrial and commercial electricity are generally based on this traditional energy source.

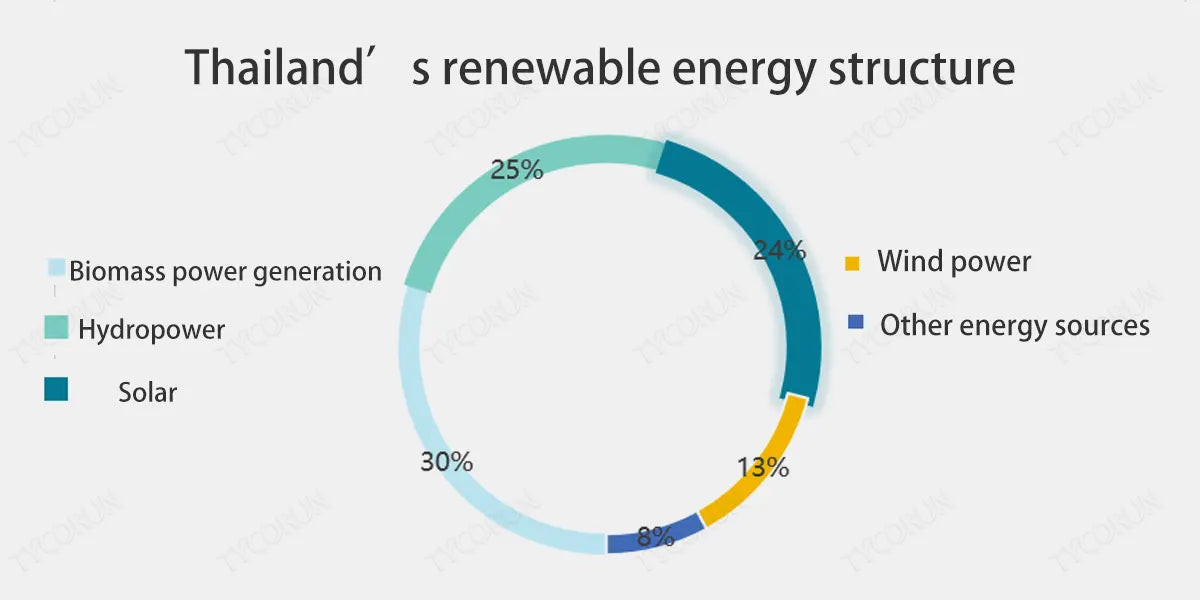

The current renewable energy structure in Thailand includes 30% biomass power generation, 25% hydropower, 24% solar power, 13% wind power and others. Over the next 25 years, Thailand will gradually shift to renewable energy sources such as photovoltaics and wind energy conversion system to become carbon neutral. Solar power in Thailand is expected to lead the transformation of Thailand's power sector with 22.8GW of new capacity. By then, the proportion of the total installed capacity of solar power in Thailand will rise from 5% today to 29%.

It is expected that the proportion of renewable energy will increase from 21% to 55% by 2040, and Thailand's total electricity demand is expected to usher in a compound annual growth rate (CAGR) of 1.6% and reach 266TWh in 2040. With 22.8GW of new capacity (equivalent to 36% of Thailand's power generation capacity gap of 62.9GW), photovoltaic power generation technology will be a far leading component in Thailand's energy transformation.

(Data source from: ENERGY BOX)

According to a new report released by APVIA (Asian Photovoltaic Industry Association) and GSC (Global Solar Council), the Southeast Asian solar market, which continues to shrink following the reduction of policy subsidies in the Vietnamese market, is about to rebound. According to the report, it is expected that the new photovoltaic capacity in Southeast Asia will reach 3.8GW in 2023, a year-on-year increase of 13%.

Although the market's annual new installed capacity has shrunk after 2021, down 68% to 4.2GW, with the policy support successively introduced by ASEAN countries, continuously reducing technology costs and growing power demand, it has created good opportunities for the recovery and upgrading of the Southeast Asian market.

2. Development advantages of solar power in Thailand

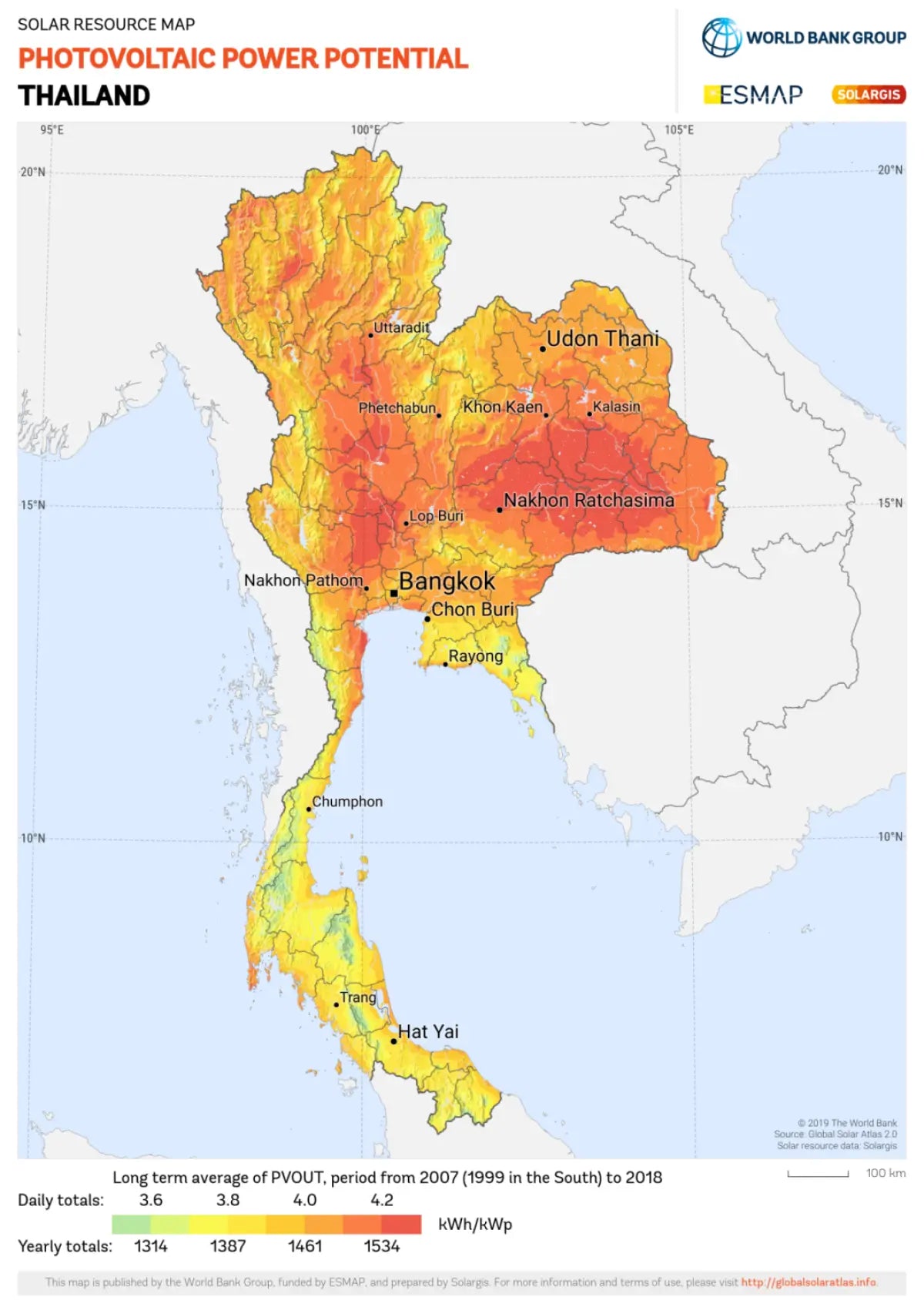

From a climate perspective, most areas in Thailand have a tropical monsoon climate, characterized by high temperatures all year round and distinct dry and wet seasons. Thailand is located near the equator, with long sunshine hours and abundant solar power in Thailand. According to statistics, the central plains of Thailand have higher sunshine hours, reaching an average of 7-8 hours a day. This provides good conditions for photovoltaic power generation.

For example, the capital Bangkok has an average annual temperature of 24℃ and more than 1,800 hours of sunshine per year, and more than 1,850 hours per year in the central and northeastern regions.

At the same time, Thailand has abundant sunshine all year round. The annual radiation is about 1800kW·h/㎡, and the radiation throughout the day in more than half of the areas can reach 5.00-5.28kW·h/㎡.

In terms of geographical location, Thailand is located in Southeast Asia and has vast land resources and population base. Moreover, when it comes to investing in educational resources, the Thai government closely follows the international perspective and devotes sufficient resources of various types to talent training. This provides good conditions and foundation for the localized construction and operation of photovoltaic power generation projects.

Thailand is well connected to the international market and is highly receptive to China's advanced technology and various resource information, which is more conducive to the introduction of high-tech technology and funds to develop the localized photovoltaic industry. Among the top ten countries for China's photovoltaic exports in the first quarter of 2023, Thailand ranked fourth with US$655 million, ranking first in Asia.

(Data source from: globalsolaratlas.info)

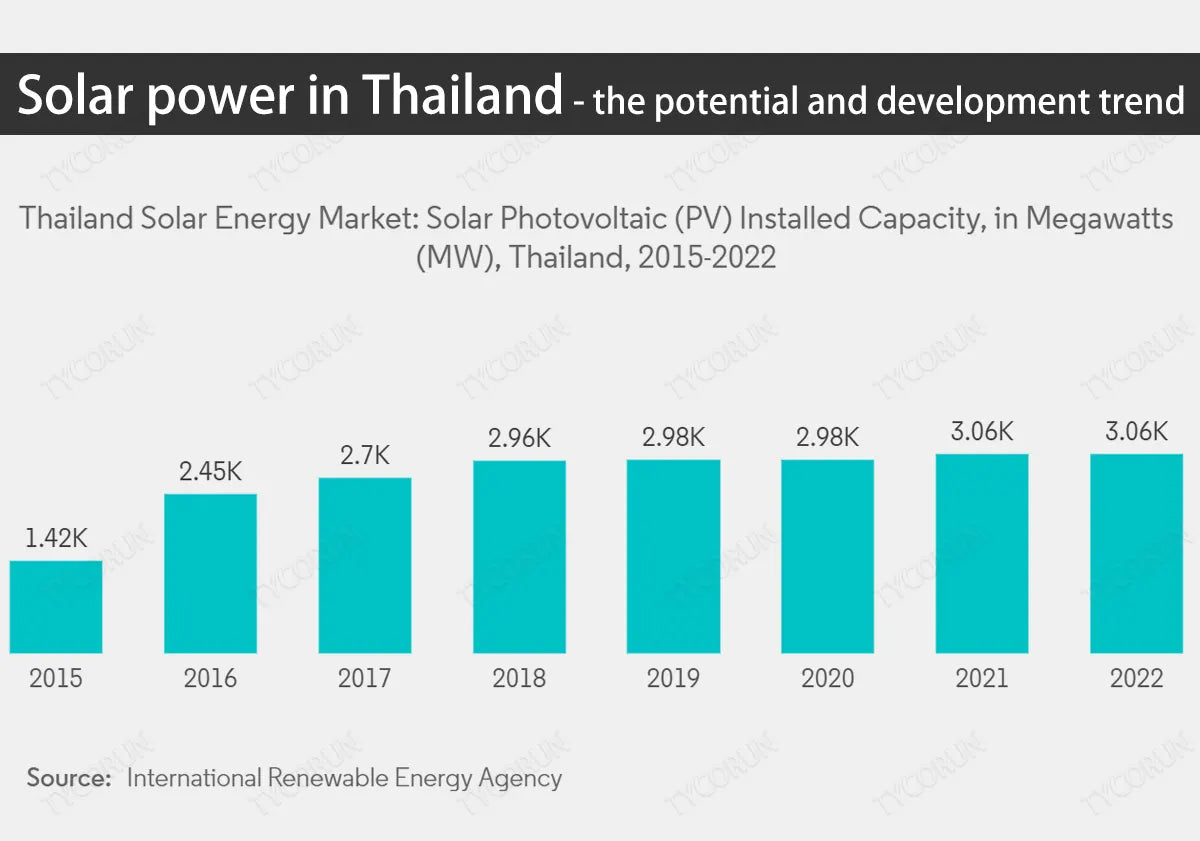

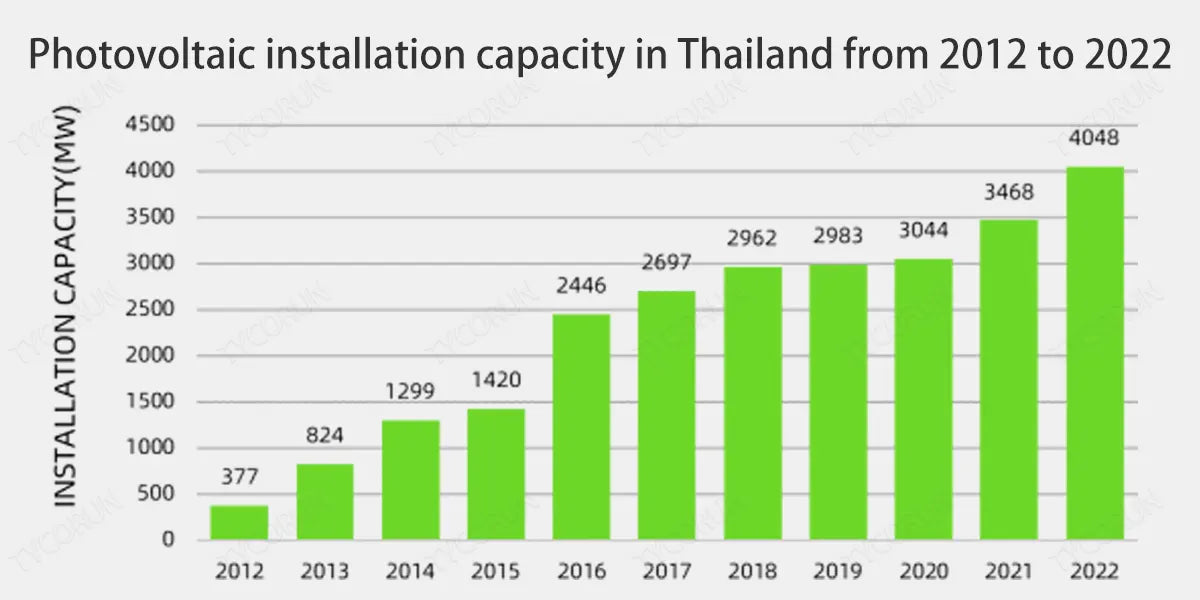

According to relevant data from the "Global Energy and CO2 Status Report 20XX" released by the International Energy Agency (IEA) over the years, Thailand's renewable energy installed capacity has been showing an upward trend from 2012 to 2022, with photovoltaic installed capacity increasing at first and then slowly.

The growth rate changed from rapid in the beginning to slower in the later period, but the overall growth is still continuing. Among them, 2016 was the strongest year for Thailand's installed capacity growth, with an annual growth rate of 73%, reaching 2.466GW. As of the end of 2022, Thailand's total installed photovoltaic capacity has reached 4.05GW, with an increase of 0.58GW in 2022, a year-on-year increase of 16.7%.

This growth is mainly due to government support policies for renewable energy, including the provision of preferential power purchase agreements, tax breaks and clean energy development funds. In addition, according to Thailand’s Ministry of Energy, the country’s installed photovoltaic power generation capacity is expected to reach 35GW in 2030.

(Data source from: ENERGY BOX)

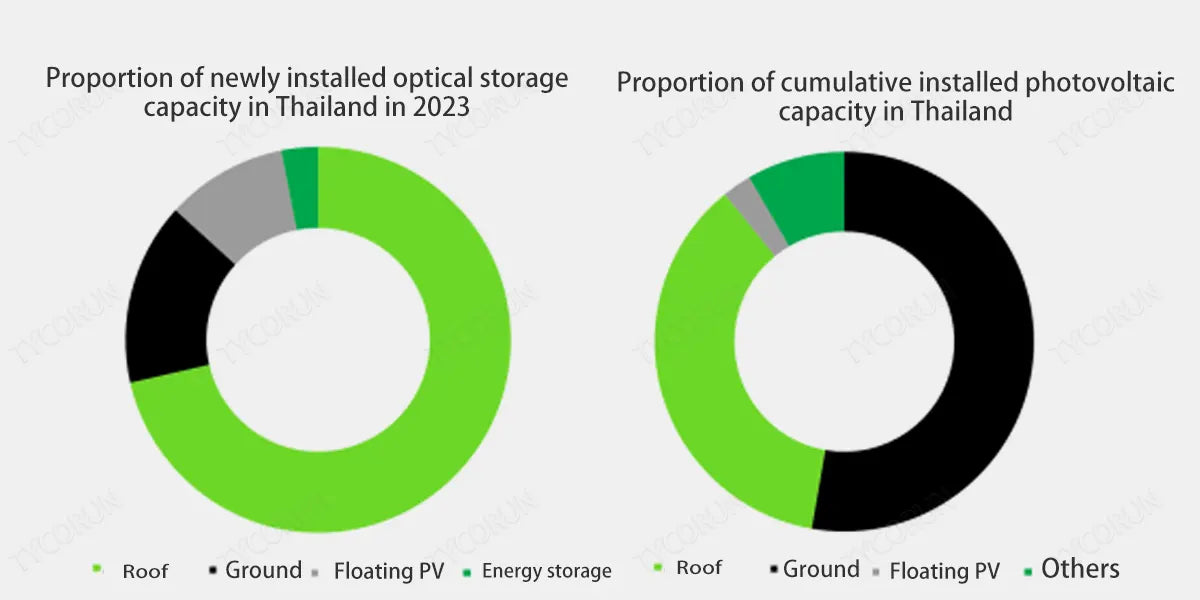

According to ENERGY BOX statistics, as of November 2023, Thailand's total photovoltaic installed capacity has reached 4.96GW, including 2.6GW ground-mounted systems and 1.8GW roof-mounted systems, as well as 546MW floating PVs and other projects.

It is estimated that by the end of the fourth quarter of 2023, the newly installed capacity for the whole year will reach 1.18GW, a year-on-year increase of 47%. Distributed photovoltaics dominate the newly installed capacity. At the same time, it is expected that in 2024, the newly installed capacity will reach 1.3GW, including 600MW of centralized photovoltaics and 700MW of distributed photovoltaics.

According to Thailand’s National Power Development Plan (PDP), by 2035, Thailand’s photovoltaic installed capacity will exceed a cumulative total of 15.6GW. In the future, Thailand's distributed installed capacity will have greater room for growth.

(Data source from: ENERGY BOX)

3. Common photovoltaic power generation systems in Thailand

In Thailand, photovoltaic power generation systems are mainly divided into two types: home solar power system and commercial/industrial system.

Home solar power system:

- Usually lower power inverters are used, generally in the range of 5-10 kilowatts (kW). Inverters like 2000w inverter or 3000w inverter are more used for portable use, like camping.

- A system of this size is suitable for rooftop installation or limited space scenarios.

- In urban and industrial areas, grid-connected inverters are more common in home and commercial PV systems.

Commercial and industrial systems:

- Commercial and industrial-level photovoltaic systems are larger in scale and require inverters ranging from 10 kilowatts to hundreds of kilowatts.

- These systems are typically used to power commercial buildings, factories, or other large facilities.

Although energy storage inverter has begun to be used in some places (such as villas, etc.), especially in areas where backup power is needed or the power grid is unstable, it seems that energy storage inverters have not been widely used in Thailand at present.

In view of the self-use function, in addition to focusing on promotion, it is also emphasized that the power generated by the solar system can be used to meet its own needs from solar power in Thailand, thereby reducing the cost of electricity.

4. Policies on electricity and solar power in Thailand

As one of the largest electricity markets in Southeast Asia, Thailand's electricity consumption reached 222 terawatt hours in 2022. With the rapid development of Thailand's industry, power demand has also shown a rapid growth trend. Among them, industrial electricity accounts for the largest share, about 47.4%, followed by commercial electricity, residential electricity and agricultural electricity. Industrial sectors such as the government and non-profit sectors use relatively little electricity.

Based on forecasts of Thailand's medium- and long-term GDP, population, per capita electricity consumption, electricity elasticity coefficient and other factors, electricity demand is expected to grow at an average annual rate of 2.3%. It is expected that by 2050, the electricity demand in Thailand will reach 403 terawatt hours.

(Data source from: ENERGY BOX)

The "Thailand Renewable Energy Market In-depth Research and Analysis Report 2023-2027" pointed out that in recent years, the Thai government has been committed to reducing dependence on traditional energy and promoting the development of clean energy. To achieve this goal, the government has introduced a series of policies to encourage private and corporate investment in renewable energy.

For example, the Thai government also implemented a "green certificate" program to encourage the development of renewable energy. The scheme allows renewable energy power stations to apply for "green certificates", each certificate representing 1 megawatt hour of renewable energy generation.

These certificates can be sold on the market to businesses or individuals who need them to encourage more people to use renewable energy. In 2021 (COP 26 Glasgow 2021), the Thai government has vigorously promoted the national energy master plan and strives to achieve the goal of carbon neutrality in 2050 and achieve net-zero carbon emissions in 2065.

According to Thai government regulations, qualified photovoltaic power generation systems can obtain renewable energy power generation subsidies, called FIT subsidies. For photovoltaic power generation projects, the subsidy amount per kilowatt hour is 2.1679 baht, and the subsidy period is 25 years.

For photovoltaic storage power generation projects, the subsidy amount per kilowatt hour of electricity is 2.8331 baht, and the subsidy period is also 25 years. The implementation of these subsidy policies aims to encourage the development and utilization of renewable energy and promote Thailand's transition to green energy.

(Data source from: ENERGY BOX)

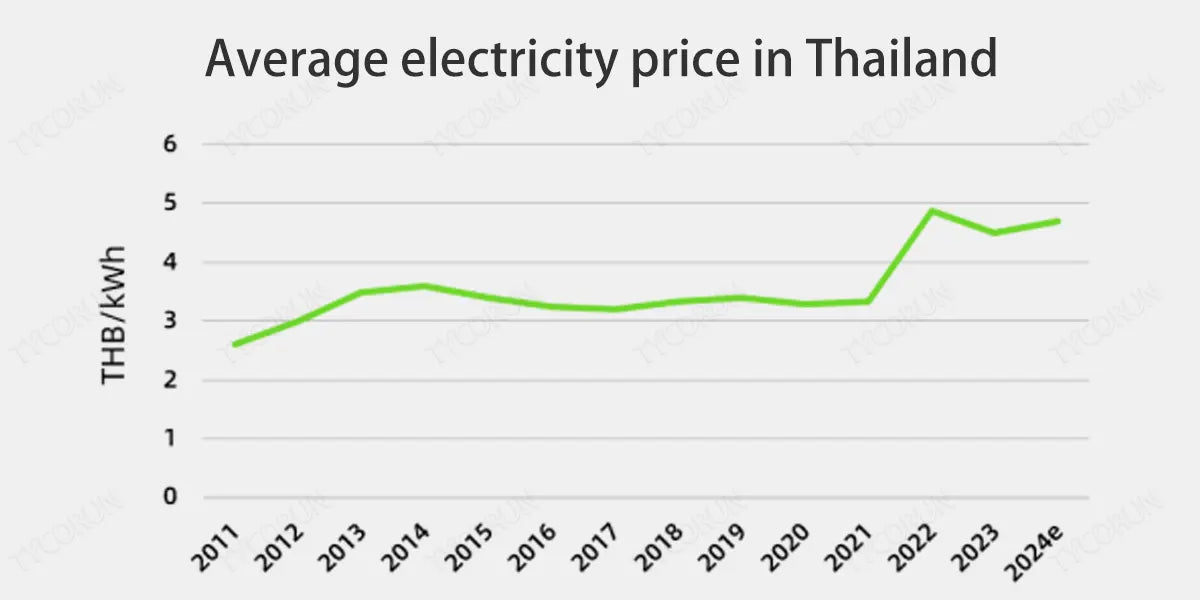

The current electricity price in Thailand is US$0.145 per kWh for households and US$0.143 per kWh for businesses, which includes all components of the electricity bill such as electricity, distribution and tax costs. At the same time, the peak-to-valley power price difference can reach 3.4 baht (including service fees).

The Thai government is continuing to plan to allocate 2 billion baht to subsidize the electricity bills of 17.7 million households based on the trial electricity price of "3.99 baht" for one quarter (September to December 2023). The plan is suitable for users who consume no more than 300 kilowatt-hours of electricity per month, so that the cost of electricity per kilowatt-hour will continue to remain at 3.99 baht.

Other policies:

Government-led initiatives include the implementation of the Alternative Energy Development Plan (AEDP, 2018-2037), which aims to increase the proportion of alternative energy sources from renewable energy, geothermal energy and biomass by 30% by 2037.

According to the AEDP 2037 target, the proportion of electricity consumption from alternative energy sources will reach 32.9%, mainly driven by solar power in Thailand. Among the total planned renewable energy capacity of 18,696 MW, solar power in Thailand is expected to provide 9,290 MW, of which floating PV will account for 2,725 MW.

The household photovoltaic net metering plan has been launched, which mainly targets solar power generation systems with a power generation capacity of more than 10kW. According to preliminary forecasts, the amount of solar power in Thailand allocated to the scheme will reach approximately 100MW.

It is worth mentioning that the net metering electricity price will be set to slightly higher than half of the current electricity price, specifically 1.68 baht/kWh, which is significantly higher than the current residential electricity price of 3.99 baht/kWh. This measure aims to encourage residents to use solar power in Thailand and promote the development of renewable energy.

At the same time, the government will continue to implement relevant policies to ensure the smooth implementation of the plan and contribute to the realization of sustainable energy development.

Related posts: global top 10 best solar inverter brands, top 10 solar inverters in Australia, solar energy in Vietnam