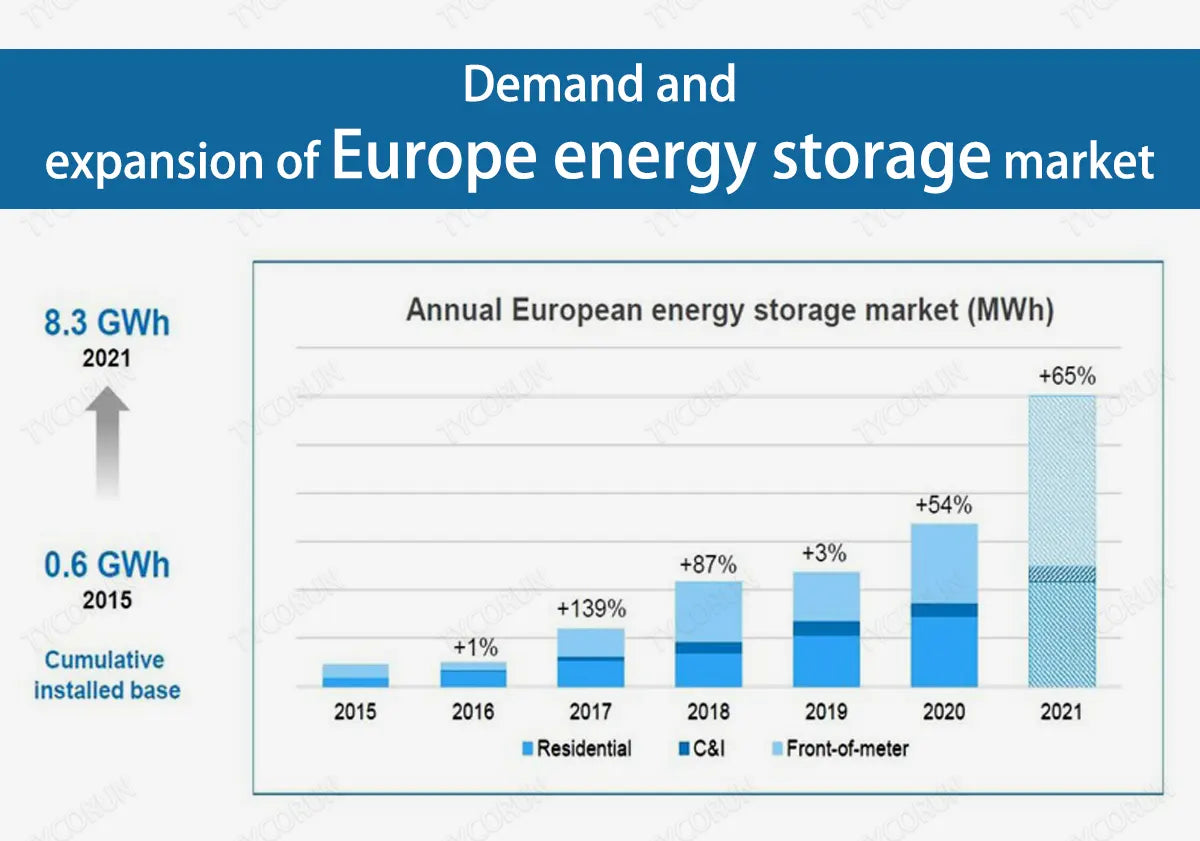

Under the energy crisis in Europe, the high economics of European household photovoltaic energy storage has been recognized by the market, and the demand for Europe energy storage has begun to grow explosively.

In 2021, the household penetration rate in Europe energy storage was only 1.3%, and according to estimates, the demand for new energy storage capacity in Europe in 2023/2025 will be 30GWh/104GWh, an increase of 113% in 2023, and a CAGR of 93.8% from 2022 to 2025.

The market demand for household energy storage in Europe is large and there is broad space for growth. This article will give you a detailed introduction to the demand and development prospects of the Europe energy storage market.

Main content:

Europe energy storage market demand

The energy crisis electricity prices soared, promoting the outbreak of energy storage demand

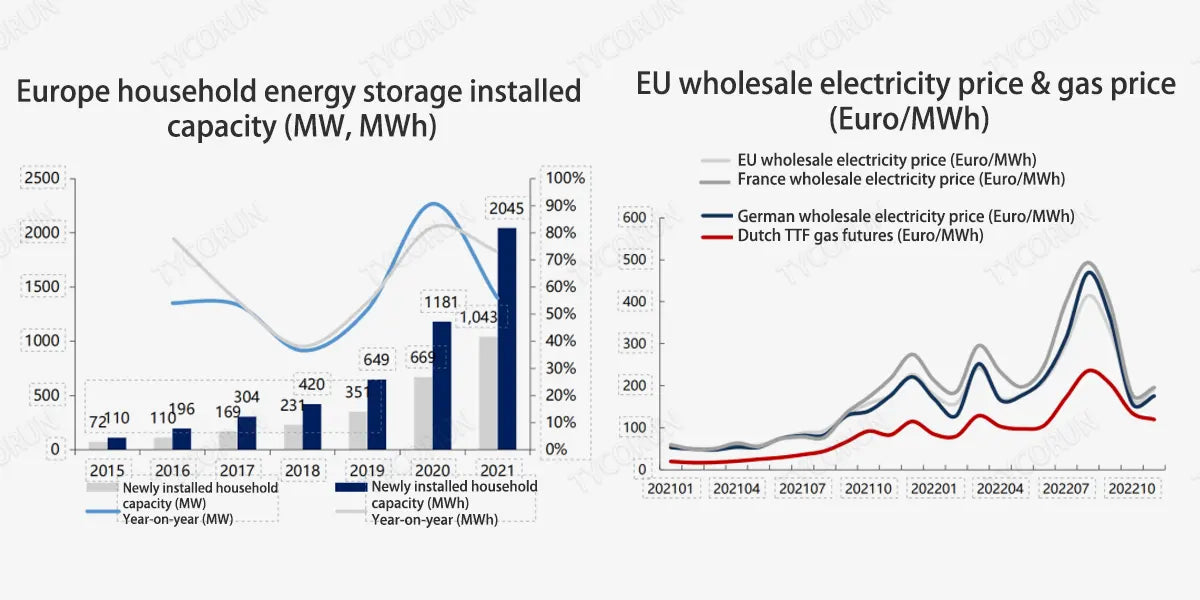

In 2021, the installed capacity of Europe energy storage household capacity of 1.04GW/2.05GWh, an increase of 56%/73%, respectively, was the core driving source of the growth of Europe energy storage.

In 2022, the European energy crisis and high electricity prices have promoted the high demand for Europe energy storage. In 2022, affected by the Russia-Ukraine conflict, Russia's gas supply has been significantly reduced, leading to a surge in energy prices in Europe, which has pushed up wholesale electricity prices in Europe all the way, and the average monthly wholesale electricity price in the EU has reached a peak of more than 400 Euros/MWh, an increase of 346% over the same period in 2021.

Under this situation, the high economy of Europe energy storage has been recognized by the market, and the demand for photovoltaic energy storage has opened an explosive growth, and in 2022, the European photovoltaic industry has reached more than 50GW, achieving double growth, and the Europe energy storage has reached about 13GWh, which has tripled.

Independent energy transformation of wind and photovoltaic energy storage

The root cause of the European energy crisis is the high dependence on external energy, and the fundamental solution is to achieve energy independence. Europe is highly dependent on traditional fossil fuels, with 97% and 60% dependence on oil and gas in 2021, according to BP, with most of the energy coming from Russia.

Therefore, under the conflict between Russia and Ukraine, the reduction of external energy supply directly leads to Europe energy storage. In the long run, only the establishment of independent energy can ensure the stability of energy supply in Europe. New energy resources such as photovoltaic and wind power have good endowment and fast speed, and energy independence can be gradually achieved with the development of energy storage.

Under the energy crisis in 2022, the economy of renewable energy led by photovoltaic is highlighted, and the penetration rate was accelerated. At the end of November, solar's share of EU power generation increased from 5% in 2021 to 7%, while wind power increased from 14.5% in 2021 to 16%.

The power system is highly market-oriented

The EU electricity system is highly market-oriented, and the participants in the flow of electricity property rights include: The power plant is responsible for the supply of electricity, which can be signed over-the-counter transactions with energy agencies through distributors (e.g., PPA), or sold online through the power market, and some suppliers own the power plant property (e.g., Vattenfall).

Suppliers supply power to consumers by signing power supply agreements with end consumers, which is highly competitive. Part of the power of the power plant is sold through PPA price. Power plants sign 10-20 year power supply contracts with downstream energy suppliers in the form of power purchase agreements (PPA).

In 2022, due to Europe energy storage, wholesale electricity prices rose sharply, PPA electricity prices also showed an upward trend, 2022Q3 average photovoltaic PPA electricity price of 68.6 Euros /MWh, the same ring increased 53.1%/14.7%, the average wind power PPA electricity price of 73.5 Euros /MWh, the same ring increased 50.9%/11.1%. Under the energy crisis, the revenue of electric power plants increased significantly, and the development of new energy was intensified.

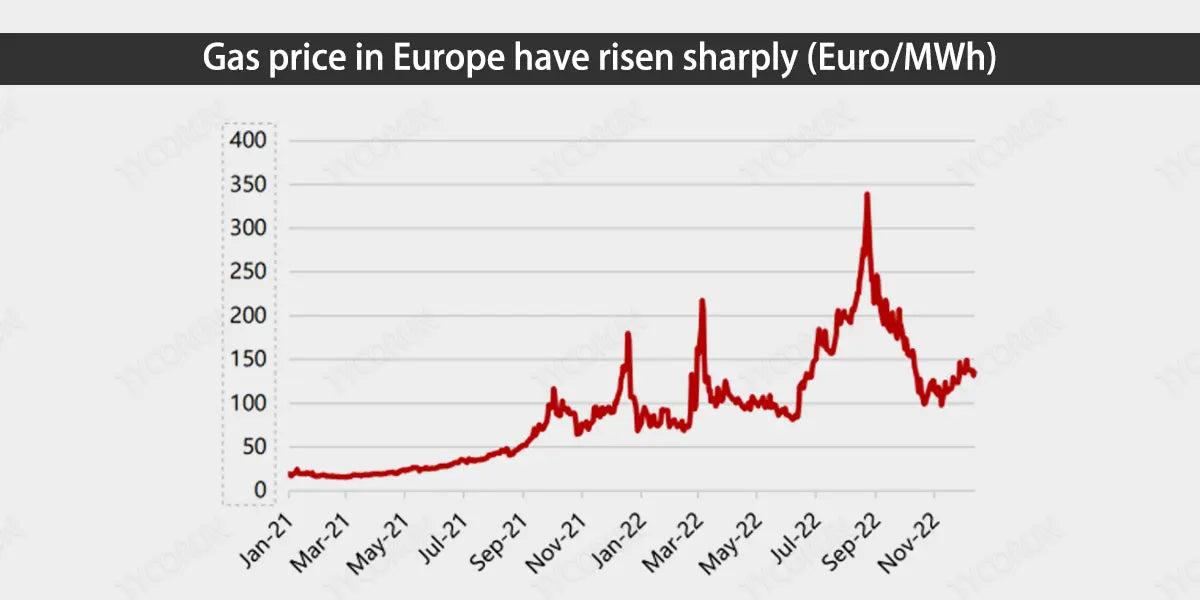

Skyrocketing natural gas costs

The EU electricity price is currently using a marginal pricing mechanism, that is, under the current power demand, the marginal cost of each power generation energy is cleared one by one according to the quantity supplied (energy like photovoltaic and wind power that with lower power generation costs are given priority), and finally the power supply price corresponding to the supply and demand balance point is unified pricing.

The advantages of this mechanism is that under normal circumstances, it can greatly improve the rationality of energy supply, encourage the development of low-cost renewable energy, and effectively reduce wholesale electricity prices under the continuous increase of the proportion of renewable energy generation at low power generation costs.

In 2022, due to the contraction of Russian natural gas supply, natural gas prices rose all the way, the highest price even rose to 339 Euros /MWh, an increase of 334% from the beginning of the year, in the marginal pricing model, resulting in European energy prices continue to rise.

The impact of national policies

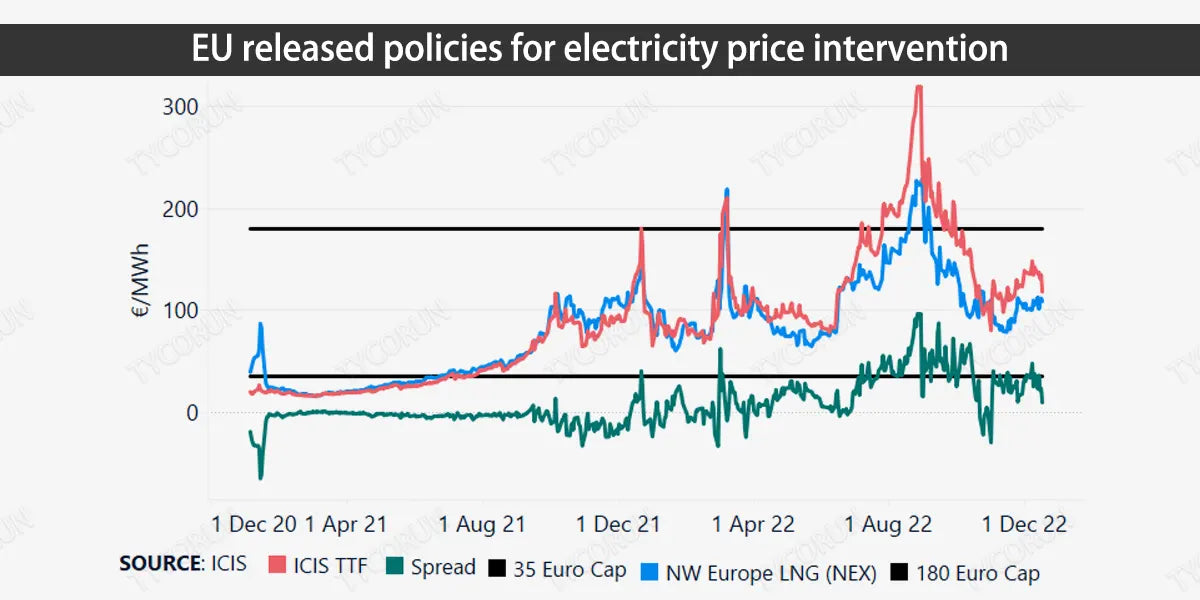

EU released policies for electricity price intervention

Under the European model of marginal pricing, electricity prices have risen sharply, and the cost of purchasing new energy power is much lower than the price of selling electricity, and thus obtain excess profits. In this context, Europe has introduced two measures:

- Market revenue CAP of €180: for renewable energy (solar, wind, hydro, etc.) generation companies, market revenue is capped at €180 /MWh for the period from 1 December 2022 to 30 June 2023;

- Windfall profits tax/Solidarity tax: For non-renewable energy (oil, gas, coal, etc.) power generation companies, any excess profits realized in 2022-2023 will be taxed at least 33%. According to the EU, the proceeds of the solidarity tax should go to energy consumers, and energy-intensive companies.

Residential electricity price contract mechanism

Europe adopts a long-term residential electricity price agreement mechanism, and the newly signed residential electricity price contracts in 2023 have significantly increased prices. Take Germany as an example, residents generally sign 1-2 year power supply contracts with service providers, and the price is negotiated by both parties.

In 2022 and before, the residential electricity contract price was around 20-30 Euros/MWh, but the electricity price of newly signed contracts have risen sharply in 2023, with the average electricity price being more than 50 Euros/MWh, a year-on-year increase of 80-120%, and is expected to continue in the next 1-2 years.

The reason for the increase in residents' electricity prices is the increase in electricity sales prices. Germany has reduced taxes and fees to reduce the burden on residents. The electricity price for German residents is calculated by adding up the electricity sales price, grid charges, EEG surcharges, electricity taxes and other expenses. The increase in wholesale electricity prices in 2022 promoted the increase in residential electricity contract prices.

In November 2022, the German residential electricity price reached to 64.19 Euros/MWh. In addition, Germany has canceled the EEG surcharge in July 2022, and European countries may still gradually reduce or cancel related taxes and fees to reduce the burden of electricity consumption on residents.

Continue to promote solar energy storage installation subsidies

Germany, Italy, and Austria will continue to introduce new subsidy policies in 2022 to stimulate the continued growth of household demand for solar energy storage. The United Kingdom currently has no subsidy policy for energy storage, but due to the country's high electricity prices, residents are more willing to install energy storage. It is expected that by 2023, Germany, Italy, Austria and the UK will remain among the top four in Europe energy storage installed capacity.

Sweden and Poland have benefited from their governments’ continued high subsidies for Europe energy storage, and optical storage has developed rapidly. The Spanish government is actively promoting support policies for optical storage. The current growth rate is relatively fast, but the base of installed capacity is smaller than that of Sweden and Poland, and the current market share is small.

|

Detailed tax exemption and subsidy rules for photovoltaic systems in major European countries |

||||

|

Countries |

Tax reduction/exemption |

Subsidy |

Policies of tax reduction/exemption |

Policies of subsidy |

|

Germany |

Yes |

Yes |

Starting from 2023, power generation income tax and 19% VAT are exempted nationwide. |

Some areas such as Berlin still have energy storage subsidies (Berlin 300 Euros/kWh). |

|

Italy |

No |

Yes |

/ |

Provides an income tax credit of 110% of the installation cost, which will gradually decrease starting from 2023. |

|

Austria |

Yes |

Yes |

Stop collecting photovoltaic power generation self-use tax (pay 0.015 Euros/kwh after the cumulative self-produced power is greater than 25kWh). |

In June 2022, a new allocation of 40 million Euros will be allocated for photovoltaic installations less than 10kW. The subsidy is up to 285 Euros/kW. |

|

UK |

Yes |

No |

VAT exempted for photovoltaic energy storage installations |

/ |

|

Sweden |

Yes |

Yes |

Installations below 500kW are exempt from energy tax (approximately 3.3 Euros cents/kwh). |

In 2021, 260 million Swedish krona (approximately 24 million Euros) will be allocated to subsidize 10%-20% of the purchase cost of rooftop solar storage. |

|

Spain |

Yes |

Yes |

Stop collecting photovoltaic power generation self-use tax (7%), and reduce the income tax by up to 20% of the purchase cost. |

The subsidy for renewable new energy in 2021 was 1.32 billion Euros, of which 220 million Euros are for energy storage subsidies. Households can receive a 70% credit for energy storage purchase costs. |

|

Poland |

Yes |

Yes |

VAT is reduced from 23% to 8%, and the purchase cost can be deducted from income tax, up to PLN 53,000 (€11,000). |

Provide a one-time subsidy of 50% of the purchase cost for household energy storage , and the maximum subsidy limit was increased from PLN 7,500 (€1,590) to PLN 16,000 (€3,400) in December 2022. |

|

Netherlands |

Yes |

No |

On January 1, 2022, some double taxation of consumption tax and production tax on energy storage systems have been stopped. |

/ |

Photovoltaic energy storage subsidy policies in Europe

Germany

In early December 2022, the German government passed tax relief policies for solar storage:

- In the 2022 tax year, electricity generation income tax was exempted for Europe energy storage systems that meet the requirements;

- All household photovoltaic energy storage systems that will be put into operation starting from 2023 will be exempted from the value-added tax (VAT, which is 19%) generated during the procurement, import and installation process. The VAT will be deducted directly when the installer quotes the price. Energy storage systems can also enjoy the same benefits, but household storage does not enjoy VAT exemption if installed separately (including additional installations).

- In September 2022, Berlin extended the SolarPLUS subsidy to the 2023 round, continuing to support household photovoltaic distribution and storage with a high amount of 300 Euros/kWh, with a maximum subsidy of 15,000 Euros.

Subsidy for the installation of energy storage in apartments or small companies is 65% of the cost, 55% for medium-sized enterprises, and 45% for large enterprises. The maximum subsidy is 30,000 Euros. SolarPLUS only subsidizes the energy storage capacity up to photovoltaic power/1.2 (12kw photovoltaic corresponds to 10kwh energy storage), and requires that the self-use ratio exceeds 50%.

Italy

In 2012, Italy launched the Superbonus program, which aims to improve the energy efficiency of residential and non-residential units in Italy and reduce the consumption of fossil fuels and natural gas, with subsidies capped at 65%. In July 2020, the subsidy was upgraded to 110% (all costs of house decoration are subsidized). The main improvement measures include replacing air conditioning equipment and replacing insulation layers.

The installation of a solar energy storage system is an additional improvement measure, and the maximum subsidy for a single solar Europe energy storage system is €48,000 per building, €1,000/kWh. The subsidy amount will be spread evenly over the next five years and used to offset individual taxes, and the additional 10% will be used to pay for technology expenses (preliminary consultation, subsequent transfer, etc.).

In November 2022, the new policy was announced that the 110% decoration subsidy will be reduced to 90% in 2023, and will be reduced to 70%/65% in 2024 to 2025. The subsidy amount will be spread evenly over the next four years and used to offset personal income tax. In addition, if the notice of commencement of construction or the application for authorization for demolition and reconstruction work is submitted before November 25, 2022, or the villa will complete at least 30% of the total work by September 30, 2022, the subsidy rate of 110% can still be maintained.

This new policy adds new applicable provisions to villa residences, which are limited to taxpayers who meet the following standards:

- The project object is the taxpayer's permanent residence;

- The taxpayer’s family income per capita is ≤15,000 Euros per year.

Development prospects of Europe household energy storage

High yield of household energy storage

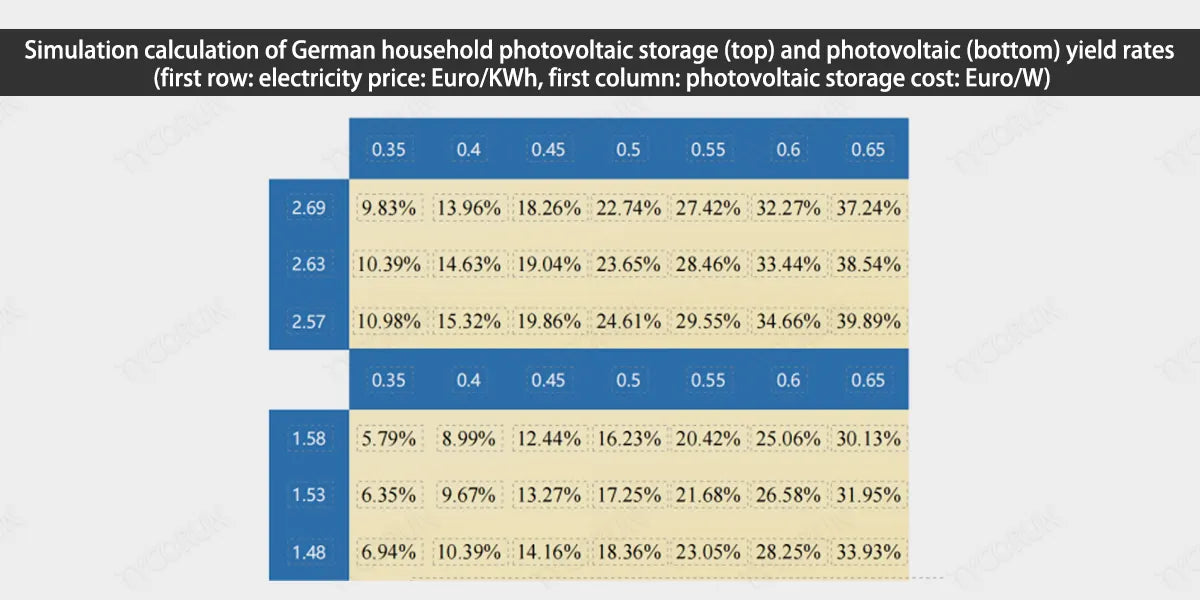

Assuming that the system consists of a 5kW inverter and a 10kWh energy storage 12v battery, the system price is a total of 16,600 Euros for the inverter, battery, components and installation costs. After the VAT exemption, the installation price is 13,400 Euros. For battery at best price, you can click to check battery stores near me.

According to calculations, under the assumption of an electricity price of 45 Euro cents, the German household photovoltaic storage system has a return rate of 18.3% (taking into account the 19% VAT tax rebate), and the payback period is 7-8 years; if only photovoltaics are installed, the IRR drops to 12.4% and the payback period takes 13-14 years.

Overall, the economics of household optical storage in Germany are relatively strong. The cost of optical storage systems is predicted to decrease in the future, and the demand for household storage will continue to increase.

Low penetration rate of household energy storage

Europe has a vast amount of developable solar and storage roof space, with 394GWh for households and 581GWh for industrial and commercial use.

- Household use:

According to Eurostat data, there are 197/041 million households in the EU/Germany in 2021. Assuming 25% of them are independent roofs (and suitable for installation), there are 49.28/10.26 million rooftops in the EU/Germany that can be installed with solar energy storage.

Assuming that each household has an average of 10kwh, the penetration rate of household energy storage in the EU/Germany was only 1.3% and 4.8% in 2021. The EU/Germany household energy storage still have 394.2/82.1GWh of developable space respectively.

- Industry and commerce

There are 23.23 million industrial and commercial households Europe energy storage in 2021. Assuming that 25% can be installed with photovoltaic roofs and an average of 100kwh per household, the EU industrial and commercial energy storage has 580.75GWh of developable space. As of 2021, the EU penetration rate was only 0.08%.

Brand channels are the key to the competition of Europe energy storage

The core barriers to Europe energy storage lie in the adaptation to energy storage inverters and brand channel advantages. As a small energy storage battery, Europe energy storage of household does not have high requirements for integrated core technology. Its core competitiveness is product design and market development, which means the key is the market brands and channel construction.

- Product design:

Mainly the adaptation to energy storage inverters such as 3000w inverter and 2000w inverter(different countries/regions have different requirements) and customized product design based on customer needs.

For example, the needs of BMS and energy storage inverters in the energy storage system, the energy storage inverter controller communicates with the BMS through the CAN interface to obtain the lfp battery pack status information, which can realize protective charging and discharging of the battery and ensure the safe operation of the battery.

- Brand accumulation and channel construction:

According to data, the biggest factor consumers consider when purchasing energy storage batteries is brand reputation. Consumers rarely know the source of the cells and components used. The quality of big brand products are more guaranteed, so the famous brands are still the mainstream.

In addition, the overseas channel certification cycle is complex and relatively long, and the channel construction and maintenance of Europe energy storage manufacturers and downstream integrators and installers is particularly important.

Related posts: Top5 home energy storage companies in China, Top 10 energy storage lithium battery companies, energy storage USA