The energy storage inverter converts AC power into DC power and stores it in the battery. When a power outage occurs, the inverter converts the DC power in the battery into AC power for use. It can provide users with a combination of grid power and battery power.

The two-way conversion between photovoltaic inverters breaks through the limitation that photovoltaic inverters can only be used during the day. This is also one of the important reasons why it is becoming more and more popular among users.

Main content:

Market size of energy storage inverter industry

Since energy storage inverters are the important link in renewable energy systems, they can ensure the long-term reliable operation of photovoltaic power stations and are a necessary component of the entire energy storage system industry chain.

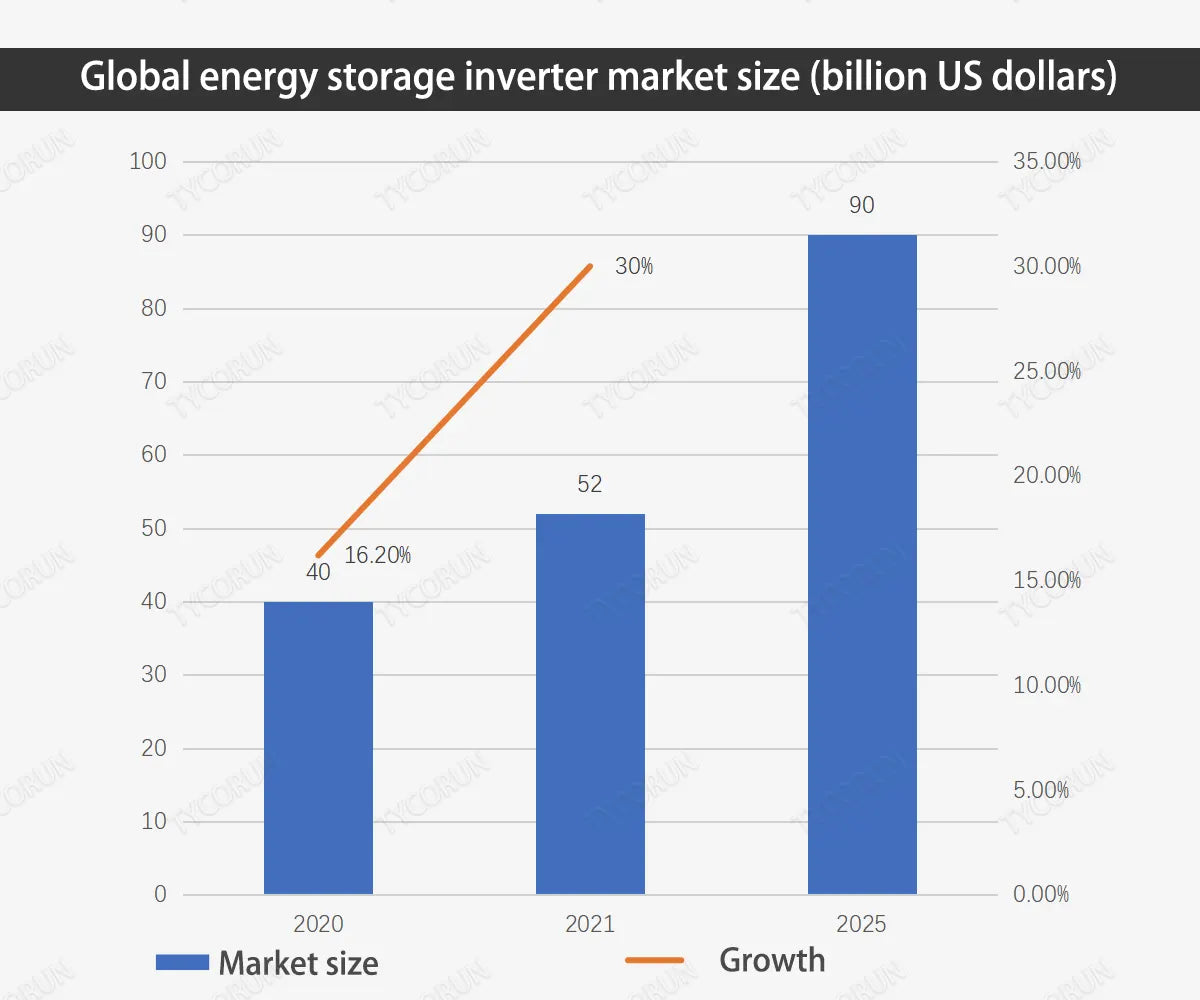

According to the global energy storage inverter industry analysis report, at the end of 2020 , the global energy storage inverter market size is approximately US$4 billion, a year-on-year increase of 16.2%. The global market size grew to US$5.2 billion in 2021, a year-on-year increase of 30%.

As the demand for renewable energy continues to increase worldwide, The global energy storage inverter market will continue to rise during the forecast period and is expected to reach over US$9 billion in 2025. In recent years, with the support of policies, the scale of chemical energy storage in China has continued to grow, driving the market demand for energy storage inverters to rise and the market size to continue to expand.

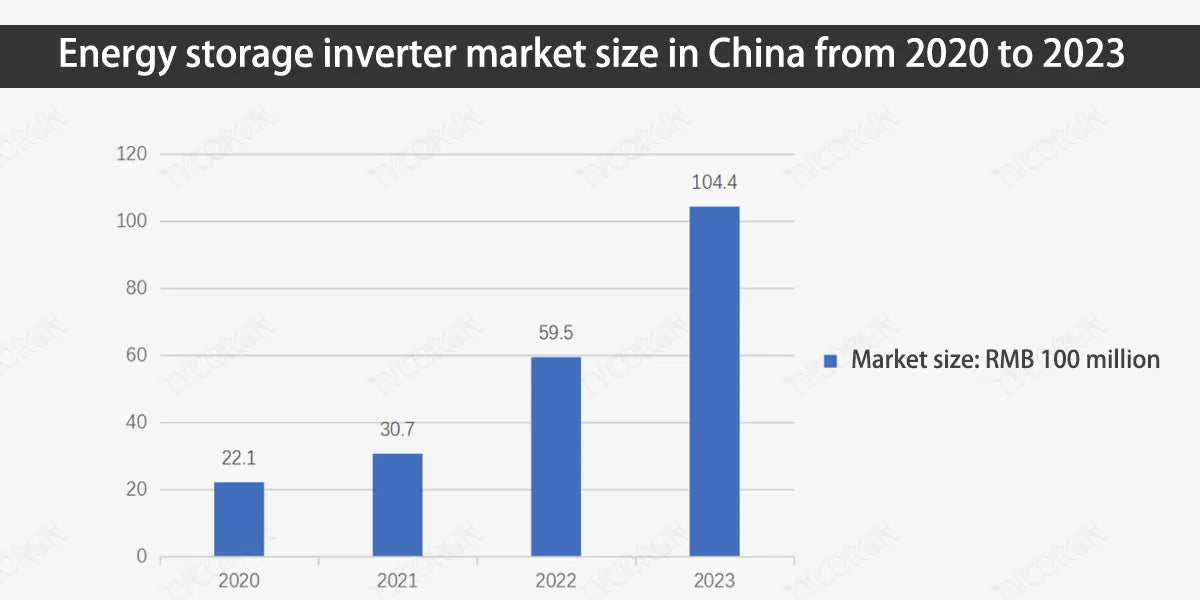

According to data, China's energy storage inverter market size grew to 3.07 billion in 2021, a year-on-year increase of 38.91%. The market size reached RMB 5.95 billion in 2022 and is expected to grow to RMB 10.44 billion in 2023.

Market prospects of China's inverter industry

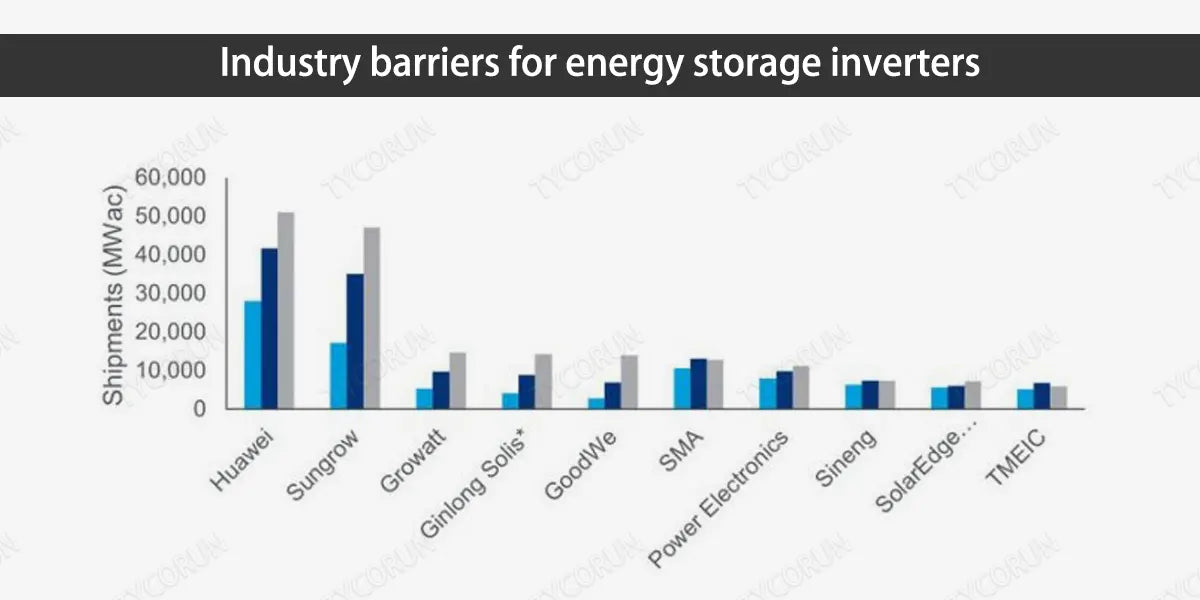

According to data, many Chinese companies are on the list among the top 10 companies in terms of inverter shipments in various markets around the world, and Huawei occupies the largest share of all markets except the United States.

At present, the U.S. market has many restrictions on Chinese photovoltaic products. The Japanese market has a strong preference for local brands, making it relatively difficult for Chinese companies to penetrate. In emerging markets such as Latin America, the Middle East and Africa, there are still large gaps in Chinese inverters.

The alternative space is expected to further increase market share. With the strengthening of environmental awareness and the urgent need for energy structure reform, the trend of renewable resources replacing traditional energy has become increasingly obvious, and the prosperity of the photovoltaic industry can continue for a long time.

Overview of energy storage inverter industry chain

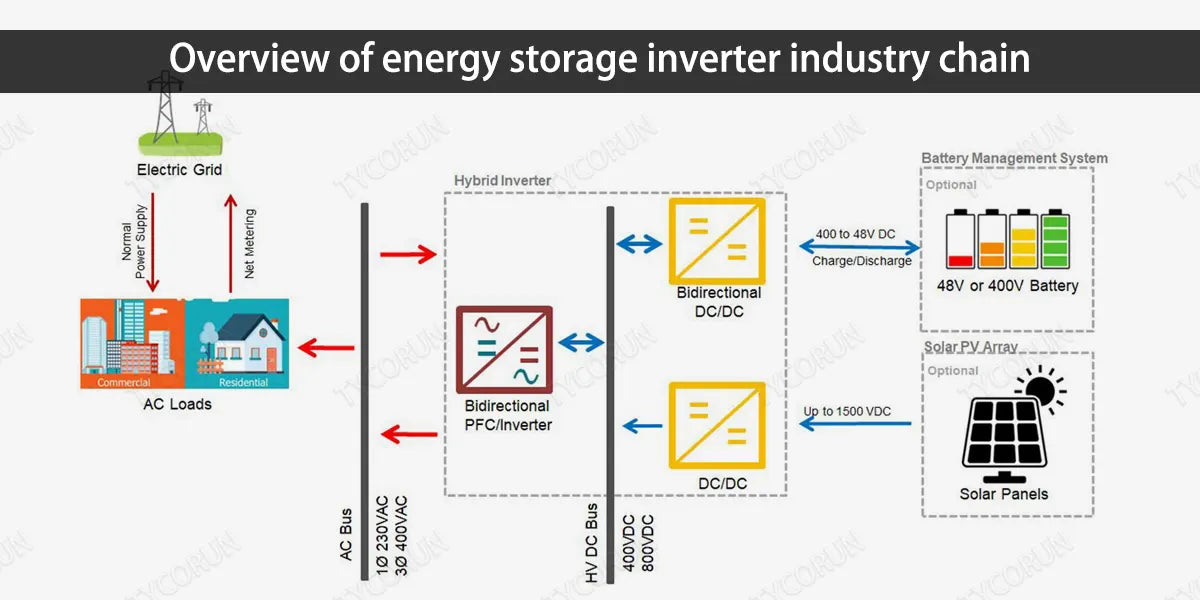

The upstream of energy storage inverters mainly consists of electronic components (power semiconductors, integrated circuits, inductors and magnetic components, PCB circuit boards, capacitors, inductors, switching devices, connectors, etc.), structural parts (radiators, die castings, cabinets and chassis , sheet metal parts, etc.) and auxiliary materials (glue, packaging materials, plastic parts and other insulating materials).

The midstream of energy storage inverters include centralized inverters, string inverters, distributed inverters and micro-inverters. Downstream of energy storage inverter industry mainly include photovoltaic power stations, distributed photovoltaic power generation, and individual and commercial users.

Upstream analysis

The upstream of energy storage inverters mainly consists of suppliers of power electronic components, structural parts, wires and cables. Among them, IGBT modules are one of the core components of energy storage inverters.

Because IGBTs have requirements for design and processing, the lack of technical talents related to IGBT, and the weak processing foundation and late industrialization has made the IGBT market monopolized by large foreign multinational companies for a long time. Since 2015, China's IGBT self-sufficiency rate has exceeded 10% and has gradually increased. It is expected that China's IGBT self-sufficiency rate will reach 40% in 2024.

Printed circuit board (PCB) is one of the core components for connecting electronic and electrical devices in energy storage inverters. Its core technology and the further improvement of China's substitution rate have promoted the development of China's energy storage inverter industry to a certain extent.

At present, China has become the country with the fastest growing output value of printed circuit boards in the world. China's printed circuit board industry is consistent with the global market. The market is relatively fragmented and highly competitive. On the one hand, most of the Japanese companies that dominate the global market have subsidiaries in China. On the other hand, China's local enterprises continue to grow and are becoming increasingly competitive.

Midstream analysis

Energy storage inverter midstream is an energy storage inverter provider, responsible for the research and development, production and sales of energy storage inverters that work with 12v battery. The power coverage of each company's products is constantly increasing to cope with more application scenarios.

The midstream energy storage inverter industry mainly provides energy storage inverters adapted to various application scenarios, but there is no absolute leader. There are certain technical barriers between PCS corresponding to different scenarios. The industry's short-term competition is low, but it will face challenges in the long term.

Downstream analysis

The downstream of energy storage inverters is mainly suppliers of lfp battery energy storage system solutions. It has four major application areas: power generation side, user side, grid side and microgrid. Due to scale effect and policy encouragement, the power generation side will promote the energy storage market in the short term in the future.

The main application scenario on the power generation side is to assist the connection of new energy power sources to the grid. The energy storage on the power generation side is often co-constructed with MW-level large-scale power stations.

The large-scale use of energy storage devices can reduce the total system cost to a certain extent, so it is more suitable for large-scale applications than on the user side. But at this stage, the energy storage system is still in the stage of increasing costs for the power generation side, and local grid side policies and measures are still in the early stages of large-scale exploration.

The main application scenario on the grid side is grid auxiliary services, which are market-oriented auxiliary services provided by grid-connected power plants or power users in addition to normal power production, including auxiliary services such as peak regulation, frequency regulation, black start, reactive power regulation, etc.

China's grid-level energy storage is growing rapidly as provinces issue relevant policies requiring new energy power generation to be equipped with energy storage and encouraging the marketization of ancillary services.

The main application scenario on the user side is distributed power generation. Most of the user-side application scenarios in China are in the direction of industrial and commercial energy storage.

The scale of power stations is relatively small and the KW level is more common. Compared with the grid side and power generation side, the configuration cost of distributed energy storage systems on the user side is high and does not yet meet the conditions for large-scale economies. However, as policies help the peak-to-trough price difference further increase, household energy storage begins to become economical.

The main application scenarios of microgrids are distributed small-scale power generation and distribution systems, which are interconnected with the power grid and can also operate independently. At present, the application of microgrid energy storage is still in the stage of rapid development, and the industry concentration is low.

Industry barriers for energy storage inverters

Technical barriers

The inverter industry has high technical barriers, and technology is one of its core competitiveness. As the "heart" and "brain" of the photovoltaic power generation system, the inverter is a technology-intensive industry. It requires a long period of practical exploration and technology accumulation in terms of product design level, device selection, manufacturing process, etc. It is difficult to accumulate knowledge on relevant technologies and various application scenarios in a short period of time.

In addition to the need for advanced hardware design and excellent manufacturing levels in the inverter industry, from the perspective of the power grid and the user, it is necessary to develop accurate algorithms as software to support the operation and use of the product.

- Grid side: The application requirements of inverters have gradually changed from "self-protection and not affecting the grid" to "traveling through faults and adapting to the grid" to "active and reactive power regulation and supporting the grid".

- User side: As the only intelligent device in the photovoltaic system that has multiple digital functions and is directly connected to the power grid, users have put forward higher requirements for the intelligence of the inverter to provide data support for the intelligent operation and maintenance of the power station.

In summary, inverter productions such as 2000w inverter and 3000w inverter have high requirements for both hardware and software, and requires companies to continue to develop and launch new products to meet the needs of all ends, so the industry has high technical barriers. For the best batteries that work with inverters, you can check the battery stores near me.

Brand reputation barriers

The inverter industry has a consumer-like attributes, with brand + channel as its core competitiveness. As the core equipment of the photovoltaic system, the inverter has high technical standards and strict selection of suppliers. Only companies with many years of experience in the industry and good market reputation can gain the trust of customers.

Therefore, once customers use a certain brand, they will maintain long-term and stable cooperative relationships. It is more difficult for new entrants to break the established relationship between industry-leading service providers and downstream customers in the short term.

Financial barriers

The inverter industry requires large capital investment. In the stage of product research and development, due to the large number of product models and fast technology iteration, a large amount of R&D resources need to be invested.

In the stage of producing and testing, the companies needs to configure automated processing production lines, high-temperature aging equipment, etc., and the equipment maintenance and overhaul will all incur expenses. During the stage of product sales, companies need to carry out marketing promotions and set up localized teams to improve after-sales service response capabilities.

For new competitors entering the industry, it is difficult to simultaneously invest a large amount of money in product research and development, product testing, and after-sales operations, making it difficult to move forward. Bidding for large-scale engineering projects therefore has certain financial barriers.

Channel barriers

From the perspective of supply chain channels, inverters are power electronic products. On the one hand, electronic components such as capacitors, inductors, and IGBTs have a greater impact on product quality. On the other hand, products are subject to aging and technology updates, requiring suppliers to be able to respond quickly to technological route upgrades on the premise of meeting the quality and timeliness of raw material supply.

From the perspective of sales channels, customers have more personalized requirements for product design, stability, after-sales service, etc. Therefore, manufacturers are required to better understand the usage scenarios and usage habits of end customers and establish an extensive marketing network.

For new competitors entering the industry, it is difficult to establish stable procurement and sales channels in the short term, so there are certain channel barriers.

Tycorun is one of the reputable inverter bands in the world, and it has a diverse selection of inverters to cater to multiple requirements and applications. Their usual inverter product lineup includes:3000w inverter, 2000 w power inverter, 1000 watt power inverter, 500 watt power inverter

Related posts: Top 10 lithium battery companies in the world, 12v 100ah lithium ion battery, best solar inverter brands